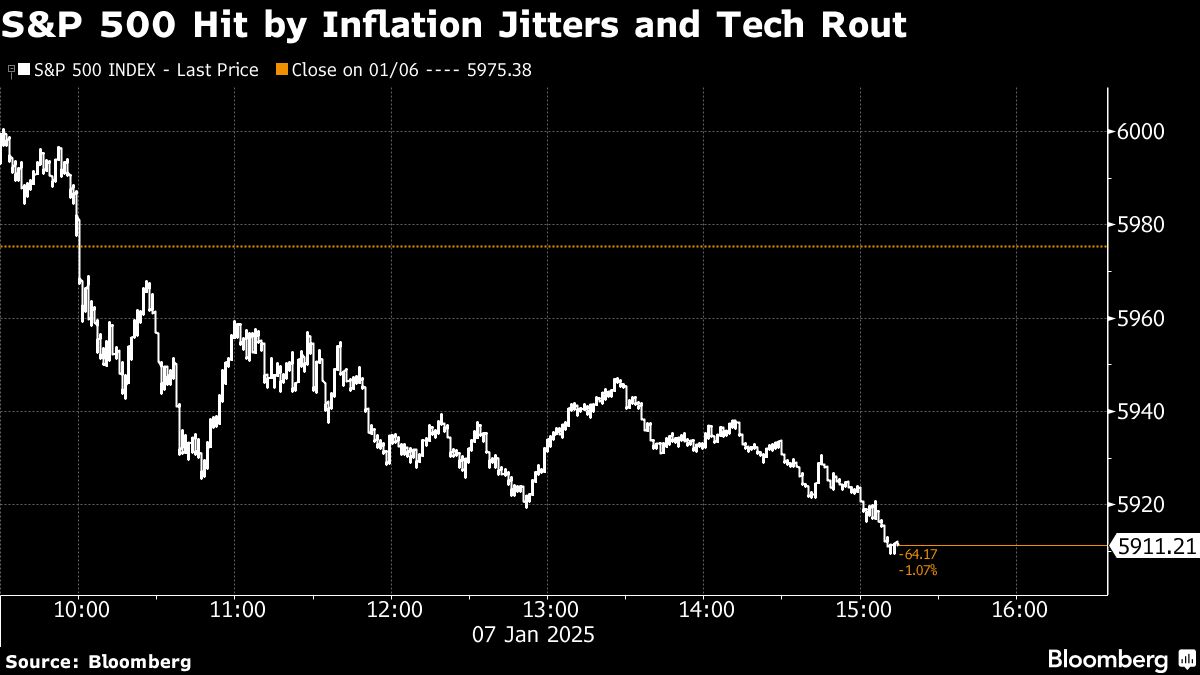

(Bloomberg) — Markets were catching their breath on Wednesday as traders assessed whether Tuesday’s selloff in US Treasuries and stocks was overblown.

Most Read from Bloomberg

US equity futures edged higher on Wednesday, indicating a calmer session after Tuesday’s sharp decline in big tech, which saw the Nasdaq 100 log its worst day in weeks. Treasuries steadied across the curve, while the dollar rose for a second day.

Markets got roiled on Tuesday after traders scrapped their bets on any interest-rate cut by the Federal Reserve until the second half of the year. Two sets of US data emphasized the risk that inflation remained sticky amid a strong performing economy.

“We see a further selloff in rates as self-defeating,” Mohit Kumar, chief European strategist at Jefferies, wrote in a note. “We are in a territory where higher rates should be negative for risky assets. A fall in risky assets would in turn drive up the demand for safe haven assets and also put pressure on the Fed, preventing a large selloff.”

Europe’s Stoxx 600 index rose for a second day. Deutsche Bank AG strategists including Maximilian Uleer said they expect European shares to outperform in 2025.

“Economic surprises continue to improve, political uncertainty is fading, a new German government likely offers more opportunities than risks and potential Chinese stimulus announcements in the first quarter add upside risk,” the strategists said.

In Asia, equities headed for their biggest one-day drop in more than two weeks. China’s benchmark stock index briefly tumbled to the lowest since September as investors remained fearful of an anticipated hike in US tariffs.

Oil rose for a second day on Wednesday after an industry report pointed to another drop in US inventories, and Bitcoin traded below $100,000.

Key events this week:

-

Eurozone PPI, consumer confidence, Wednesday

-

US ADP employment, Fed minutes, consumer credit, Wednesday

-

Fed’s Christopher Waller speaks, Wednesday

-

China CPI, PPI, Thursday

-

Eurozone retail sales, Thursday

-

US state funeral and national day of mourning for former President Jimmy Carter is a federal holiday, Thursday

-

Fed’s Patrick Harker, Thomas Barkin, Jeff Schmid and Michelle Bowman speak, Thursday

-

Japan household spending, leading index, Friday

-

US jobs report, consumer sentiment, Friday

Some of the main moves in markets: